All Categories

Featured

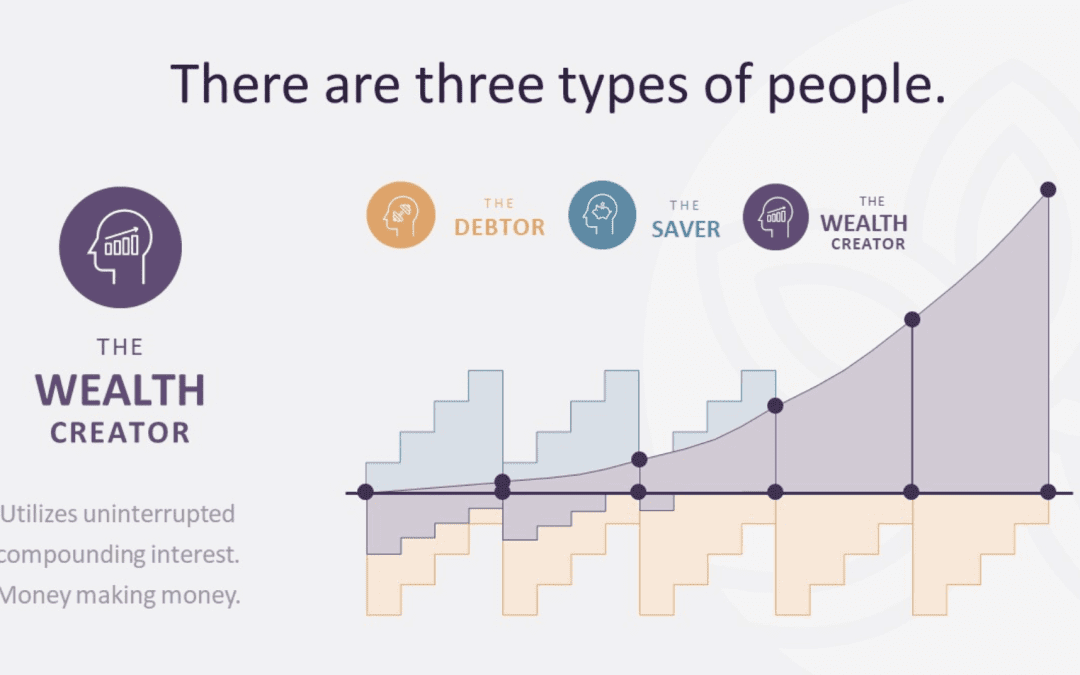

Entire life insurance coverage policies are non-correlated assets - Infinite Banking vs traditional banking. This is why they function so well as the economic foundation of Infinite Banking. No matter what happens on the market (supply, real estate, or otherwise), your insurance coverage policy preserves its well worth. Way too many individuals are missing out on this necessary volatility barrier that assists secure and expand wealth, instead splitting their money right into 2 pails: checking account and investments.

Market-based financial investments expand riches much faster yet are exposed to market fluctuations, making them inherently dangerous. Entire life insurance policy is that 3rd bucket. Infinite Banking concept. Infinite Banking benefits.

Latest Posts

Become Your Own Bank

Nelson Nash Bank On Yourself

Be Your Own Banker Life Insurance